The Global Shipping Report

August 2024 U.S. Container Imports Dip Below July’s Historic Levels but Remain High

In August 2024, U.S. container imports dropped slightly from the highs seen in July 2024 but remain above the 2.4 million twenty-foot equivalent unit (TEU) mark that has historically caused stress to the U.S. maritime logistics infrastructure. August’s volume of 2,479,284 TEUs represents a 3% decline from July, which is consistent with the peak season drop seen in 2019 prior to the pandemic hitting. August volumes demonstrate robust year-on-year performance, posting a strong 12.9% increase over August 2023 and a similarly strong 15.7% increase over 2019. A second month of high container import volumes has, however, contributed to an increase in port transit delays at the majority of the top 10 U.S. ports.

Following suit with overall U.S. volumes, August container imports from China decreased 4.7% from July’s record high but showed a robust 17.2% gain over the same month last year. August’s update of logistics metrics monitored by Descartes reinforces the strength of U.S. container imports since the start of 2024. Despite strong performance, global supply chain challenges are likely to persist in the latter half of the year. Contributing factors include the conflict in the Middle East and unresolved labor disputes at ports along the U.S. South Atlantic and Gulf Coast.

In this Article...

- toc

U.S. container imports in August 2024 remain high.

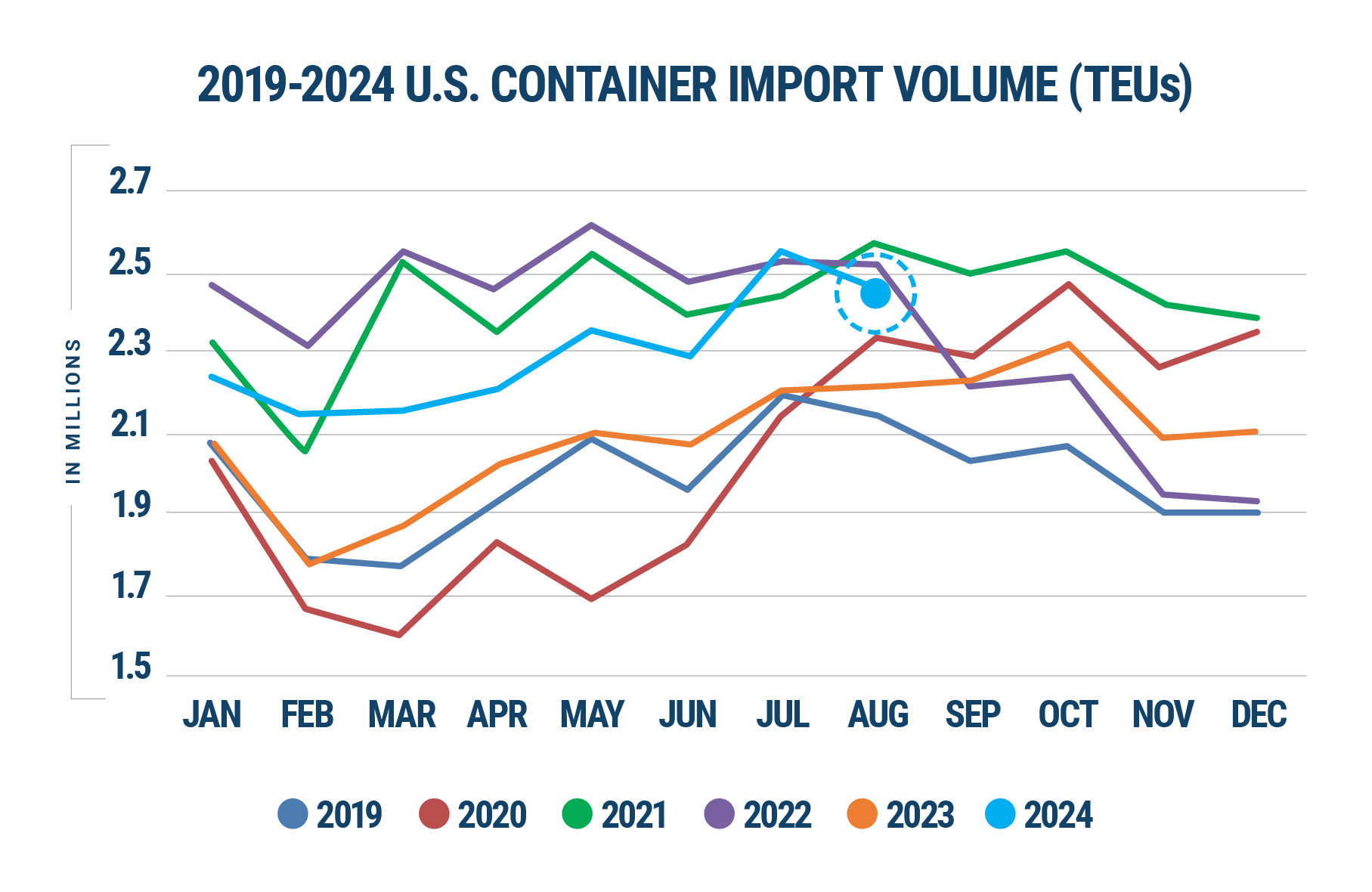

August 2024 U.S. container import volumes showed strong performance over August 2023 volumes (see Figure 1), increasing 12.9% to 2,479,284 TEUs. While August volumes declined 3% from the exceptional high seen in July (2,556,180 TEUs), which represented a 26-month high since the all-time high set in May 2022, they remained above the 2.4 million TEU level that created port congestion and delays during pandemic years. Versus pre-pandemic August 2019, August 2024 import volume was up 15.7%.

Figure 1: U.S. Container Import Volume Year-over-Year Comparison

Source: Descartes Datamyne™

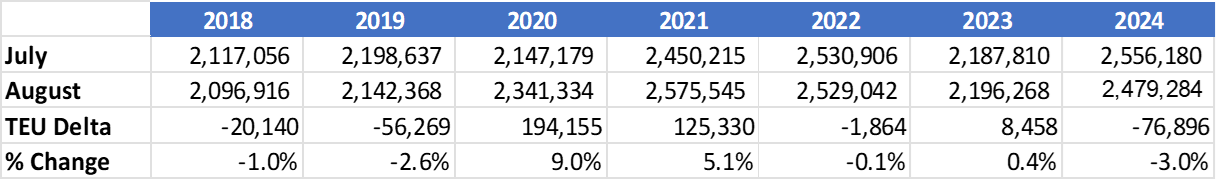

The volume decrease in August from July is consistent with the monthly decline seen in 2019 before the pandemic hit. August 2024 volumes ranked as the third highest for the month in the past six years, behind the high set in August 2021 by 96,261 TEUs (see Figure 2).

Figure 2: July to August U.S. Container Import Volume Comparison

Source: Descartes Datamyne™

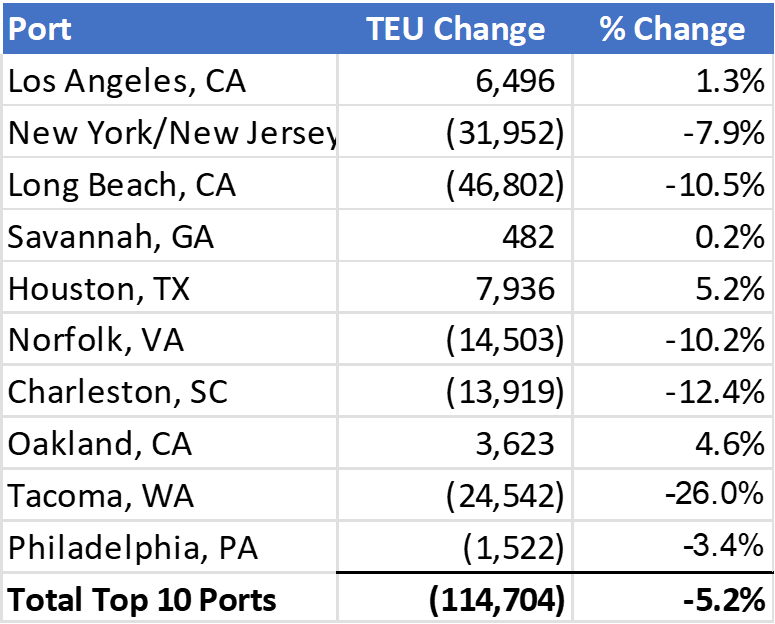

For the top 10 U.S. ports, container import volume in August 2024 decreased 114,704 TEUs (down 5.2%) versus July 2024 (see Figure 3). The ports of Houston (up 7,936 TEUs) and Los Angeles (up 6,496 TEUs) experienced small increases over July while the ports of Long Beach (down 46,802 TEUs), New York/New Jersey (down 31,952 TEUs), and Tacoma (down 24,542 TEUs) recorded the largest month-over-month volume declines.

Figure 3: July 2024 to August 2024 Comparison of Import Volumes at Top 10 U.S. Ports

Source: Descartes Datamyne™

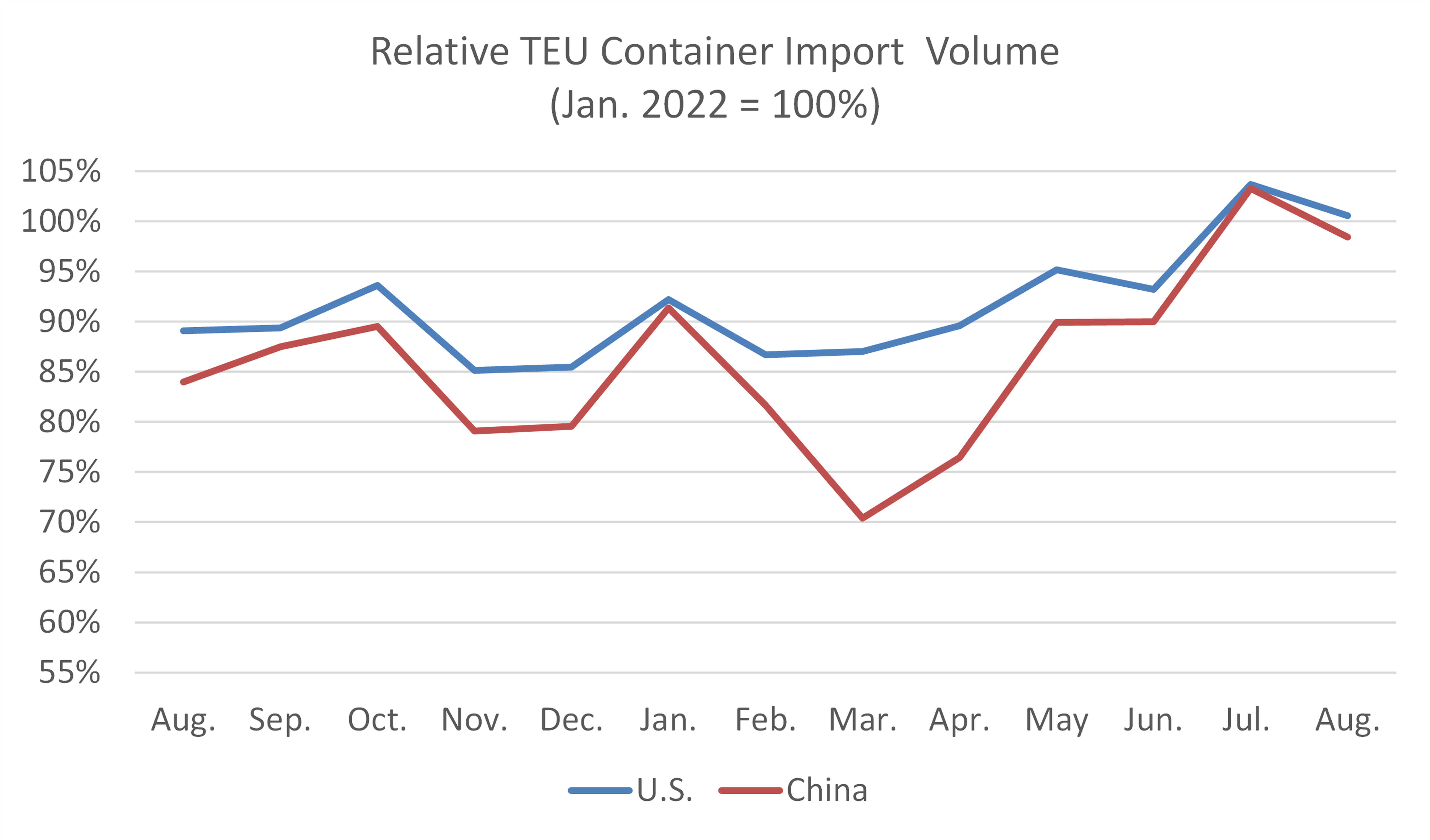

In August 2024, U.S. import volume from China was 975,129 TEUs, down 4.7% (48,076 TEUs) compared to the high set in July 2024 (1,022,913 TEUs) (see Figure 4). Despite being down from the previous month, imports from China recorded a robust 17.2% gain over the same period last year. The top two commodity codes (HS-2s) in August 2024 are consumer-oriented goods such as HS-94 (Furniture, Bedding, etc.) and HS-95 (Toys, Games and Sports Equipment, etc.). China represented 39.3% of the total U.S. container imports in August, a decrease of 0.7% from July and 2.2% below the high of 41.5% in February 2022.

Figure 4: August 2023 – August 2024 Comparison of U.S. Total and Chinese TEU Container Volume

Source: Descartes Datamyne

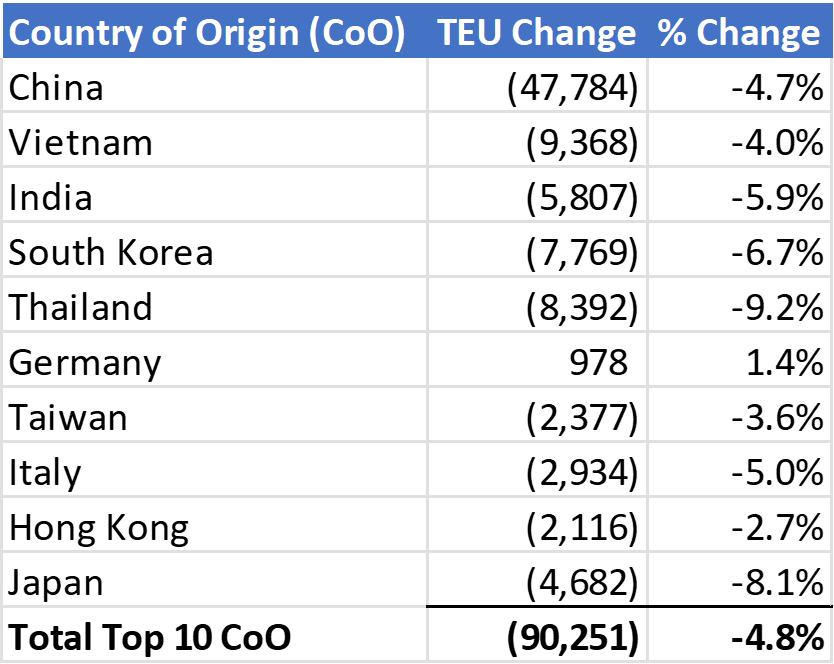

For the top 10 countries of origin (CoO), U.S. container import volume in August 2024 dropped 90,251 TEUs, a 4.8% decline from July (see Figure 5). Germany was the only country from the top 10 countries of origin to record a gain in August, growing a modest 1.4% (978 TEUs) from July. China recorded the largest decrease in volume with a loss of 47,784 TEUs, followed by Vietnam (down 9,368 TEUs), Thailand (down 8,392 TEUs), and South Korea (down 7,769 TEUs).

Figure 5: July 2024 to August 2024 Comparison of U.S. Import Volumes from Top 10 Countries of Origin

Source: Descartes Datamyne

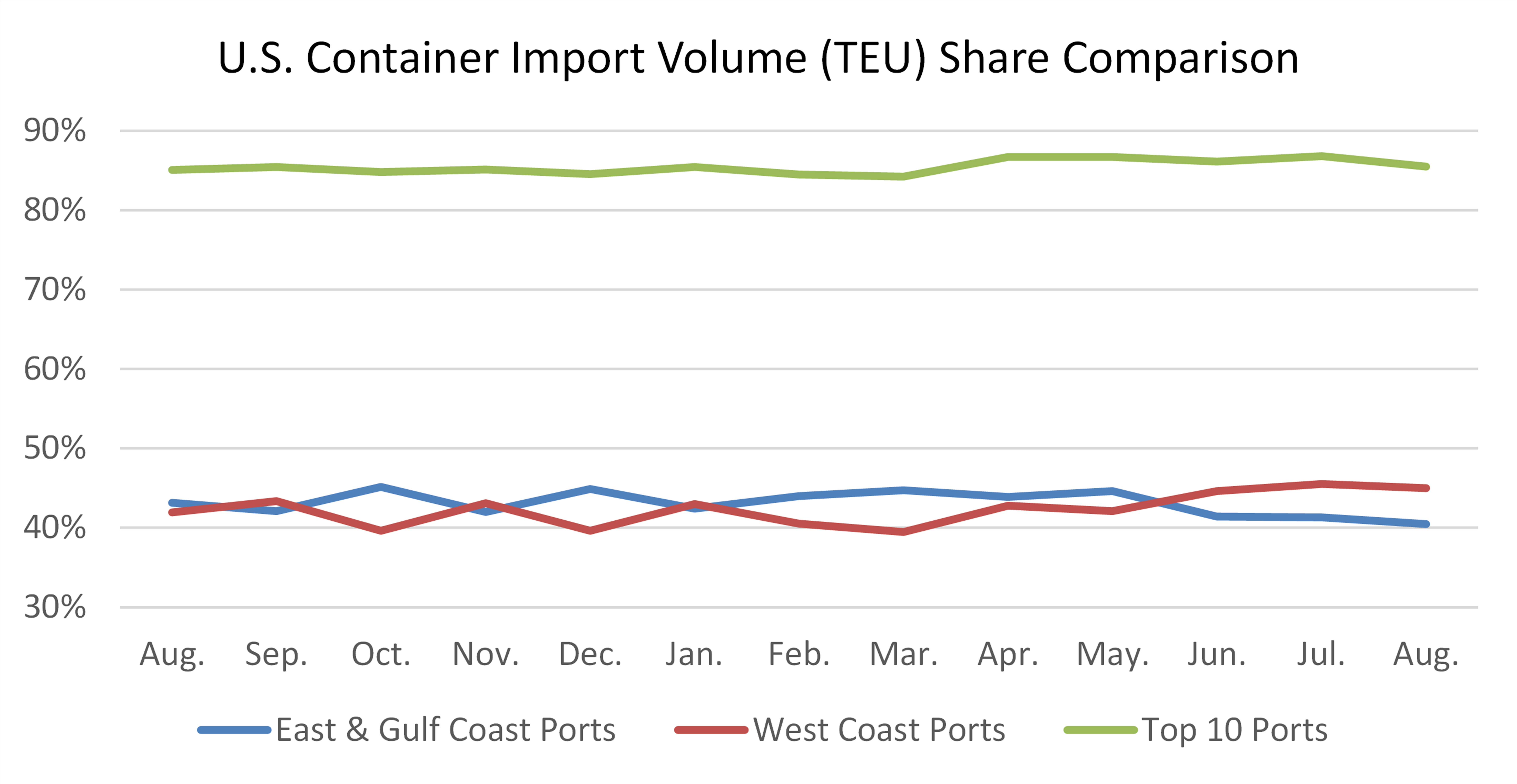

West Coast ports maintain a larger share of import volumes in August 2024.

In August 2024, the West Coast ports continued to hold a larger share of container import volumes compared to the East and Gulf Coast ports. The volume share at West Coast ports decreased slightly from 45.5% in July to 45.0% in August. At East and Gulf Coast ports, the volume shared declined from 41.3% in July to 40.5% in August. As a whole, the top 10 ports experienced a slight decrease in their share of total container import volumes, declining from 86.8% in July to 85.5% in August.

Comparing the top five West Coast ports to the top five East and Gulf Coast ports shows that, while most ports are facing a drop in import volumes, the West Coast continues to hold a steady position. This data highlights a marginal shift in volume distribution between these major U.S. ports, but the overall dominance of the top 10 ports remains stable (see Figure 6).

Figure 6: Volume Analysis for Top Ports, West Coast Ports and East and Gulf Coast Ports

Source: Descartes Datamyne

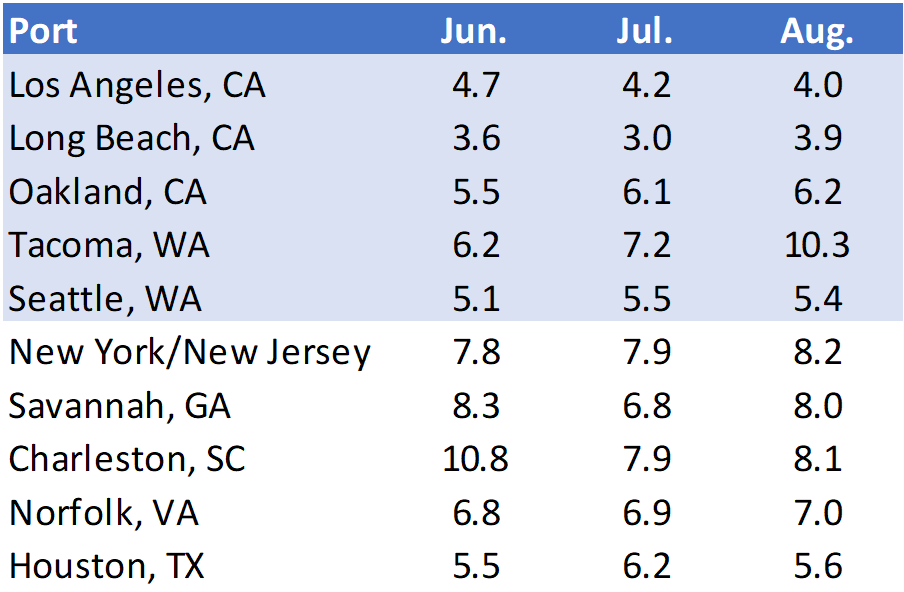

Port transit time delays increase at West and East Coast Ports.

For the top 10 U.S. ports, overall port transit time delays in August increased from July with seven of the top 10 experiencing increasing delays. The West Coast port of Tacoma saw the largest increase in delays, with transit times rising sharply by 3.1 days to 10.3 days compared to 7.2 days in July, despite a decline in import volume. One report indicated that higher volumes at the Port of Tacoma in previous months had strained rail cargo capacity and caused some carriers to shift imports to other ports. The East Coast port of Houston saw the greatest improvement, reducing delays by 0.6 days.

Other changes include marginal improvements at the West Coast ports of Los Angeles and Seattle where delays decreased in August by 0.2 days and 0.1 day respectively. On the East Coast, New York/New Jersey saw delays rise to 8.2 days, continuing a slight upward trend.

Figure 7: Monthly Average Transit Delays (in days) for the Top 10 Ports (Jun. 2024 – Aug. 2024)

Source: Descartes Datamyne™

Note: Descartes’ definition of port transit delay is the difference as measured in days between the Estimated Arrival Date, which is initially declared on the bill of lading, and the date when Descartes receives the CBP-processed bill of lading.

Red Sea attacks continue to push maritime traffic to Cape of Good Hope.

The conflict in the Middle East and maritime attacks and ongoing threats by the Houthi from Yemen continue to divert carries away from the Suez Canal to Cape of Good Hope, elevating traffic at South African ports and raising carrier costs. Revenue at the Suez Canal has been reported to have declined by nearly half of what was typically seen prior to the Red Sea crisis. Shipping concerns will likely increase if the Middle East is further destabilized.

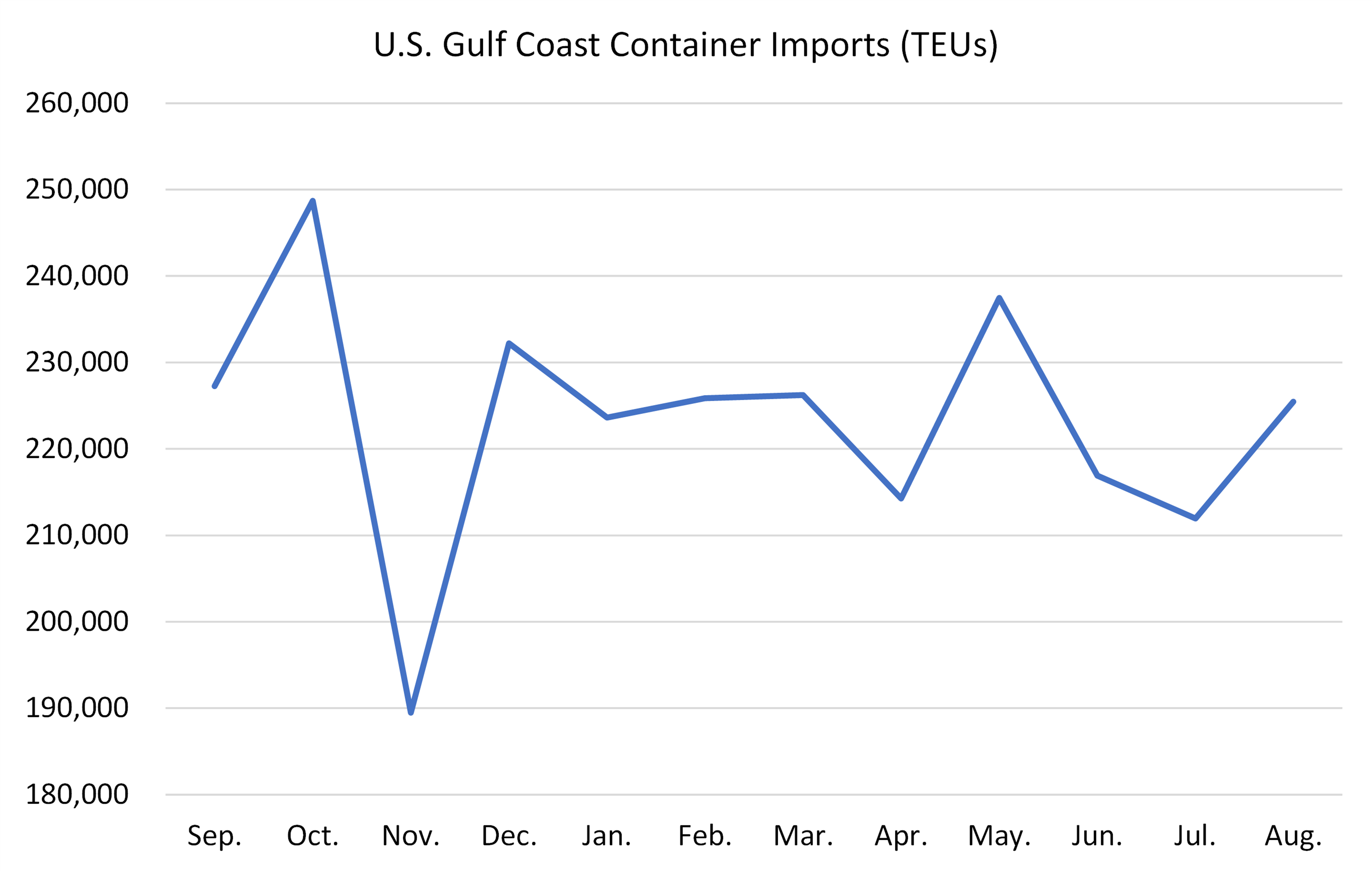

Gulf Coast imports regained momentum in August 2024.

Recovering from declines experienced in both June (down 8.7%) and July (down 2.3%), import volumes at Gulf Coast ports reversed the downward trend in August, reaching 225,474 TEUs. This marks a 6.4% increase compared to July (see Figure 8). Port transit times at Gulf Coast ports remained consistent in August, showing slight improvements from the delays encountered in July.

Figure 8: Descartes Datamyne graph depicting Gulf Coast container imports from September 2023 to August 2024

Source: Descartes Datamyne™

To access other articles that track port congestion monthly, visit the

Global Shipping Resource Center

White Papers

Survey Uncovers Supply Chain Strategies of Top Performing Companies

Surviving Peak Season and Beyond: The Essential Guide to Supply Chain Resiliency

The Must-Read Guide on U.S. Maritime Ports

Gain deep insights into 2023 U.S. imports and learn how to mitigate risks in your supply chain.

Stay Informed. Download the Report.

Port of Baltimore nearly doubles import volumes from July 2024.

Following the reopening of the port in June, import volumes still lag their historic levels, however, August volumes nearly doubled compared to July totals. Imports at the port reached 34,550 TEUs—a 96.3% increase from July’s 16,952 TEUs. Comparing year-on-year, August 2024 volumes were 12,360 TEUs behind August 2023 but month-over-month imports continue to show promising signs for a full recovery.

International Longshoremen’s Association (ILA) talks with United States Maritime Alliance (USMX) remain stalled.

The potential severity of trade disruption stemming from the expiration of the ILA and USMX agreement is currently unknown. The agreement is scheduled to expire at the end of September 2024 and, if no resolution is reached, labor action could disrupt operations at South Atlantic and Gulf Coast ports. ILA leadership has communicated that they do not intend to extend the current agreement and have advised members to brace for the possibility of a coast-wide strike in October 2024.

Managing supply chain risk: what to watch in 2024.

U.S. container import volume remained high in August 2024, exceeding the 2.4 million TEU mark. The economy continues to exceed expectations, however, elevated container import volumes, the ongoing conflict in the Middle East, and pending ILA contract negotiations may create challenges for global supply chains. Here’s what Descartes will be watching for the remainder of 2024:

- Monthly TEU volumes between 2.4M and 2.6M. This level will continue to stress ports and inland logistics until infrastructure improvements are made. With August U.S. container import volumes nearing 2.5M TEUs, ports may be beginning to struggle.

- Port transit wait times. If they decrease, it’s an indication of improved global supply chain efficiencies or that the demand for goods and logistics services is declining. August 2024 transit delays increased at both West Coast and East Coast ports.

- The economy. The U.S. is an import-driven economy, so economic health is an important indicator of container import volumes. Following the July 31 Federal Open Market Committee (FOMC) meeting, the Federal Reserve borrowing rate remained at 5.3% to slow inflation which increased in July by 0.2% from June’s reported 3.2%. According to the Bureau of Labor Statistics, the unemployment rate grew by 0.2% to 4.3% in July while employers added just 114,000 jobs—significantly below the average monthly gain of 215,000 over the prior 12 months. The next FOMC meeting is scheduled for September 17-18.

- Middle East conflict. Houthi attacks are continuing to influence carriers to forego the Suez Canal, extending transit times around the Cape of Good Hope. The impact of diversions away from the conflict is still minimal on volumes or transit delays for East and Gulf Coast ports.

- ILA/USMX contract negotiation. A potential strike at South Atlantic and Gulf Coast ports could disrupt U.S. container imports later in 2024. The possibility of a coast-wide strike in October is looming.

Consider recommendations to help minimize global shipping challenges.

While down slightly from elevated July 2024 levels, August 2024 U.S. container import volumes performed well above the same month last year. Port transit delay times worsened over the previous month, influenced by another month of overall high container import volumes. The Port of Baltimore accelerated its recovery, nearly doubling its month-over-month import volumes. The ongoing conflict in the Middle East is creating pressure on global supply chains that could cause disruptions throughout the remainer of 2024, and stalled negotiations between the ILA and USMX could fuel disruption at South Atlantic and Gulf Coast ports in the months ahead. Descartes will continue to highlight key Descartes Datamyne, U.S. government and industry data in the coming months to provide insight into global shipping.

Short-term:

- Evaluate the potential impact of an ILA strike in October 2024 on South Atlantic and Gulf Coast ports to determine alternate ports or trade lanes.

- Monitor East Coast port volumes to assess the recovery of the Port of Baltimore.

- Track the Middle East conflict as carriers divert shipping around Africa, impacting shipping capacity and timeliness.

- Evaluate the impact of inflation and the Russia/Ukraine and Israel/Hamas conflicts on logistics costs and capacity constraints. Ensure that key trading partners are not on sanctions lists.

Near-term:

- For companies that have cargo moving through the Suez Canal, evaluate the impact of extended rerouting caused by Middle East conflicts.

Long-term:

- Evaluate supplier and factory location density to mitigate reliance on over-taxed trade lanes and regions of the globe that have the potential for conflict. Density creates economy of scale but also risk, and the pandemic and subsequent logistics capacity crisis highlights the downside. Conflicts do not happen “overnight” so now is the time to address this potentially business disrupting issue.

Note: This report uses the initial compiled release of U.S. Customs and Border Protection (CBP) data and is subject to revision later by CBP. The revised data can be seen in Descartes Datamyne.

Notes:

1. This report uses the initial compiled release of publicly available U.S. Customs and Border Protection (CBP) Bill of Lading (BOL) data for all U.S. ports, which provides a standard, official source of data for reporting on maritime trade. This data can be subject to modification later by CBP. The modified data can be seen in Descartes Datamyne™ where U.S. maritime records are processed daily. Descartes Datamyne is ISO 9001 certified.

2. In Descartes Datamyne™, twenty-foot equivalent units (TEU) are calculated using a combination of container size and weight as declared on Bills of Lading filed with U.S. Customs and Border Protection (CBP).

How Descartes Can Help

Descartes Datamyne delivers business intelligence with comprehensive, accurate, up-to-date, import and export information.

Our multinational trade data assets can be used to trace global supply chains and our bill-of-lading trade data – with cross-references to company profiles and customs information – can help businesses identify and qualify new sources. Ask us for a free, no obligation demonstration of our data on a product or trade commodity of your choosing – and keep the custom research we create with our compliments.